How It Works

Key Features

- Works automatically – employee is not able to choose when (or if) they are tracked.

- Very accurate information – distances measured every 5 seconds, 15 second GPS position updates and screens updated every 60 seconds.

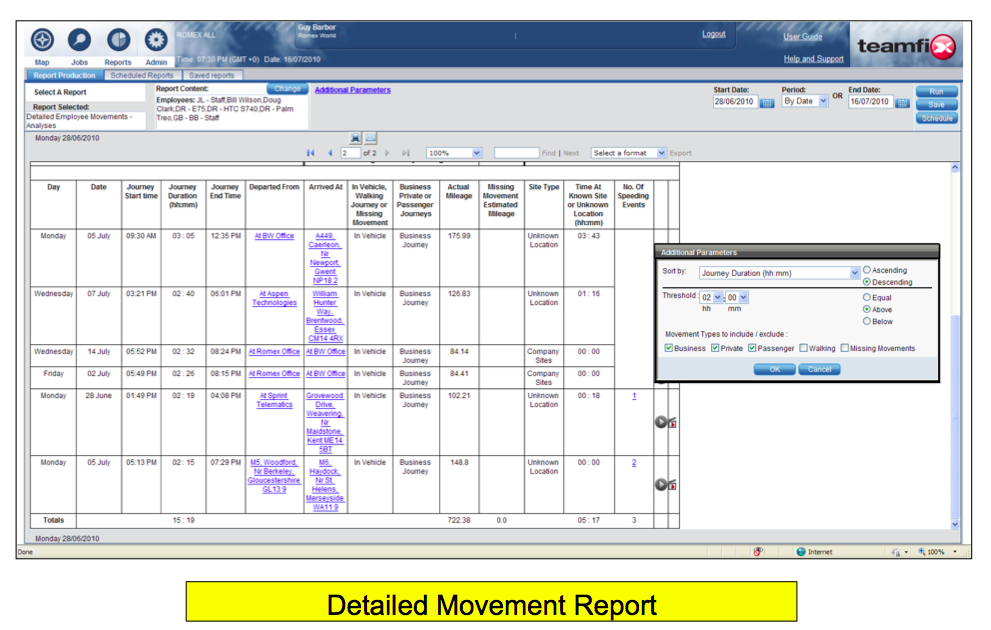

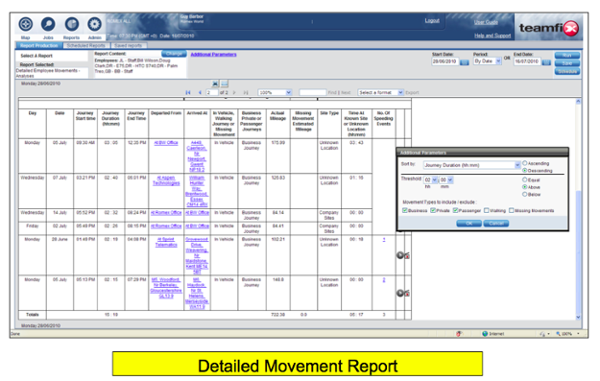

- Tracks all movements – Business, Private, Passenger and Walking journeys (i.e. no gaps in the information during the working day).

- Can be used in any vehicle (including the ‘Grey Fleet’).

- Manages abuse – records more than 40 events and settings on the smartphone (or rugged device), and time is managed independently from what appears on the phone.

- Minimises battery drain – proprietary technology.

- Privacy is fully automated – no employee or union issues.

Key Benefits For Your Business

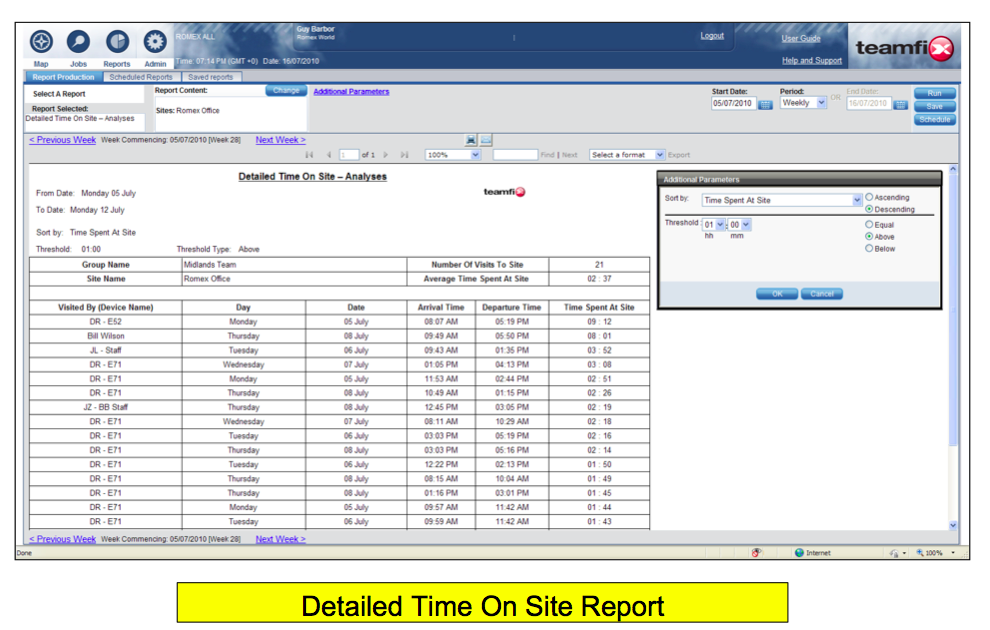

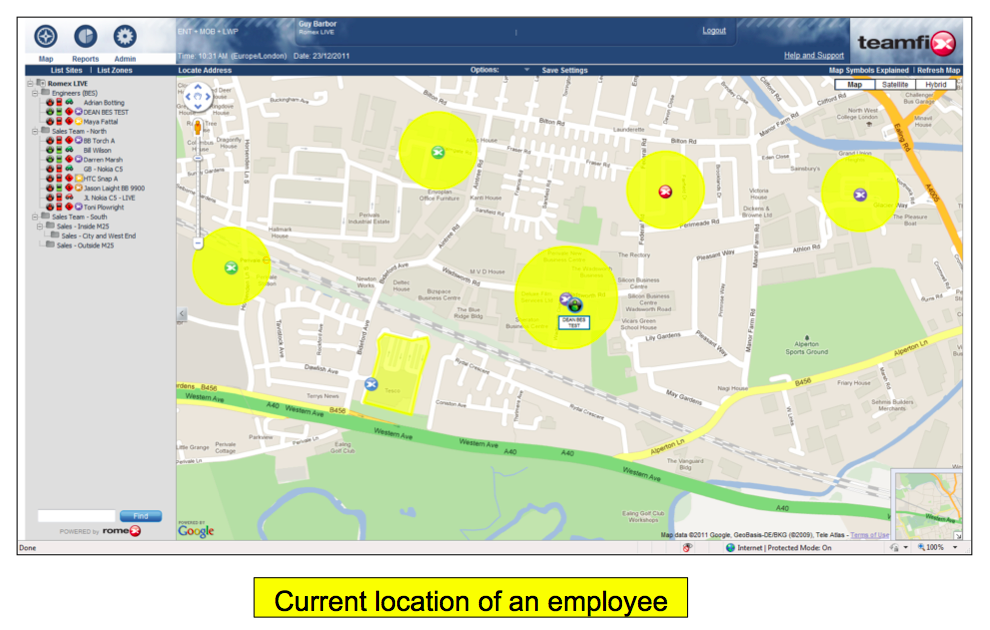

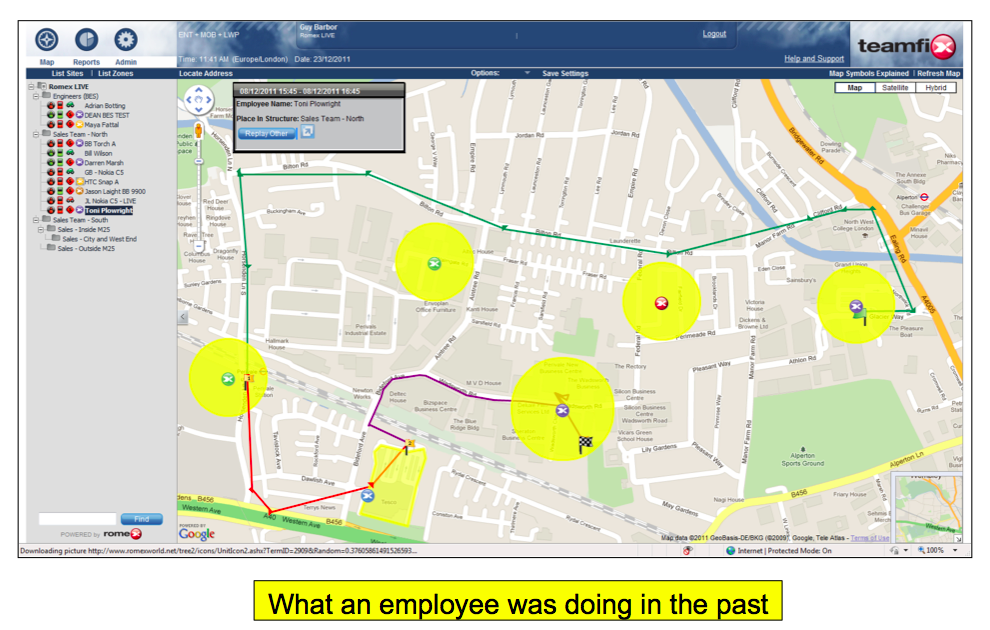

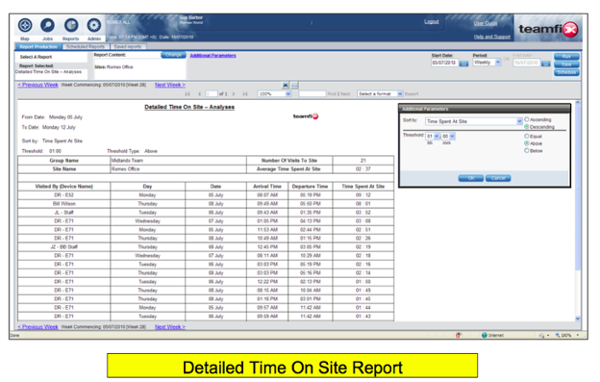

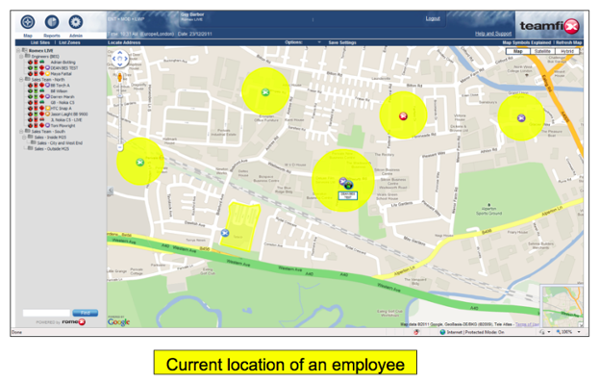

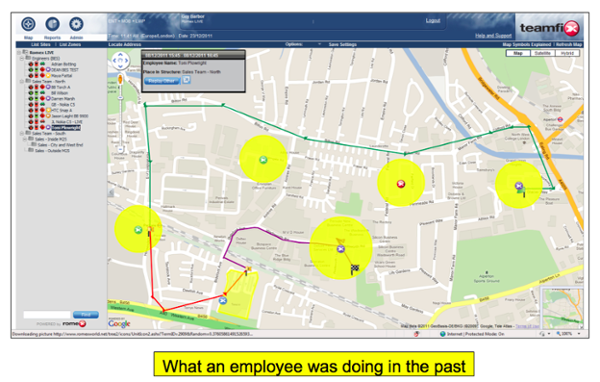

- Measure and validate actual performance ‘minute by minute’ using GPS (typically accurate to +/- 5 metres)

- Reduce costs (e.g. valid overtime and business mileage claims)

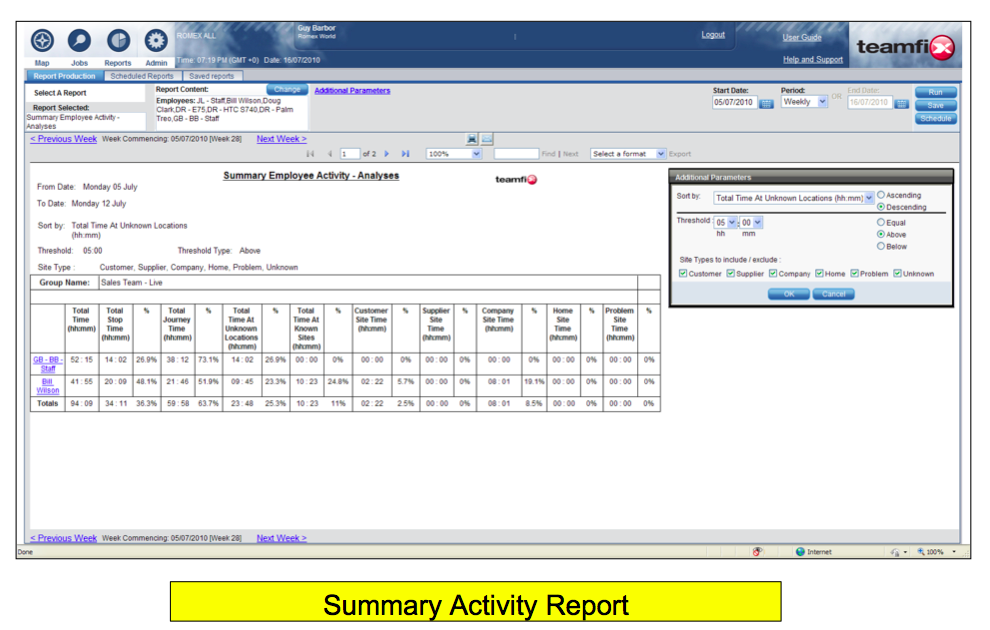

- Improve productivity by reducing non-productive time and travel

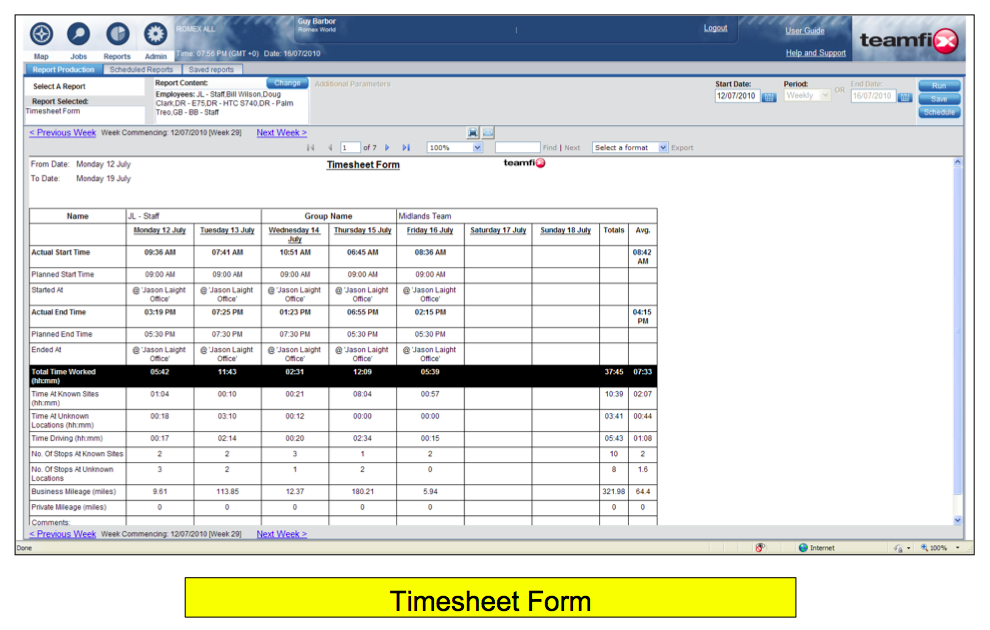

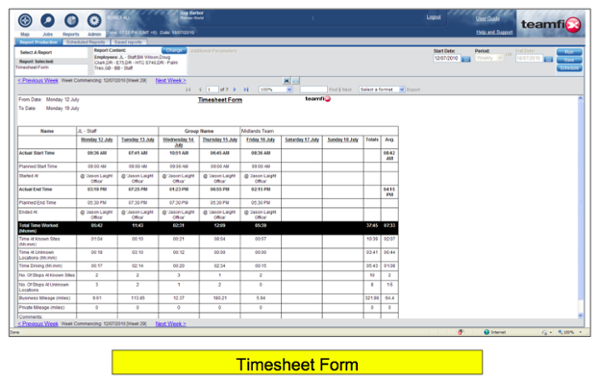

- Reduce administration (e.g. timesheets, mileage claims etc.) both for mobile employees and office staff

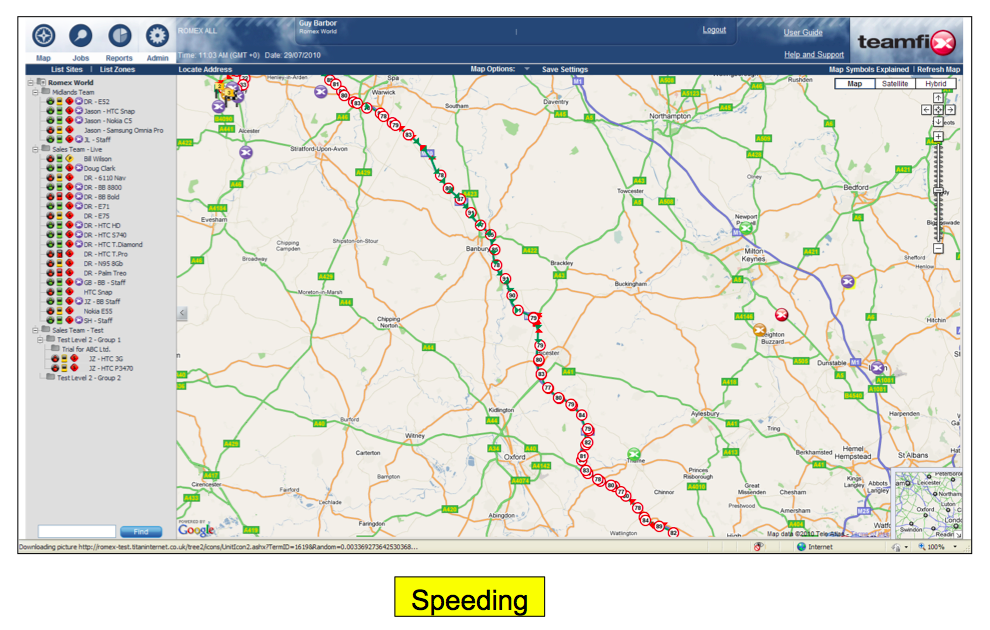

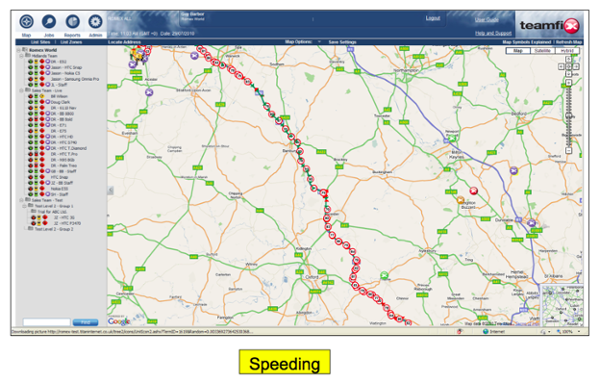

- Lower fuel usage and related vehicle costs (e.g. maintenance) by reducing non-productive mileage and speeding

- Reduce carbon footprint on the same basis

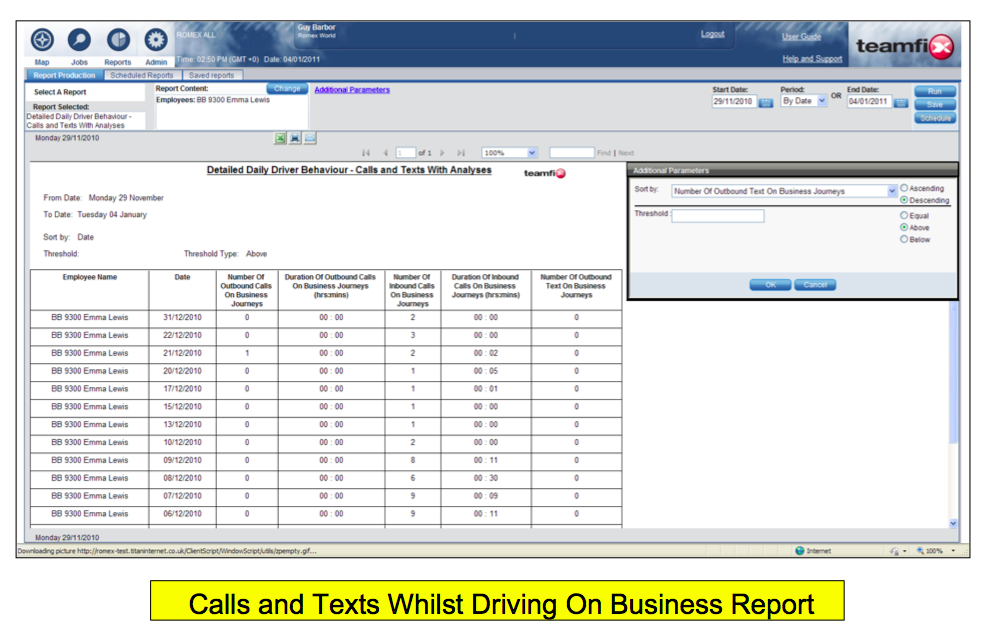

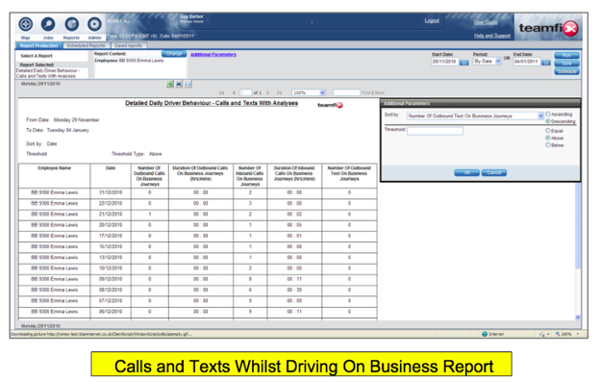

- Reduce ‘Bent Metal and insurance costs by managing driver behaviour (e.g. speeding, fatigue and distractions)

- Improve employee safety at work and whilst driving

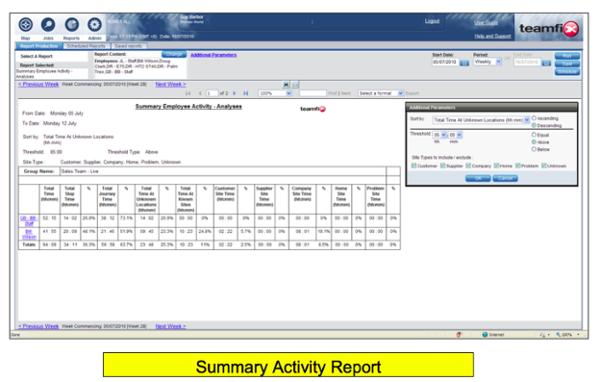

- Provide management with appropriate levels of visibility and enable different teams or operations to be analysed and compared

Screnario

- An employee is paid the National Average wage of £27,200 per annum (2011). They do a 40 hour week.

- Allowing for NI contributions and benefits of 5% their hourly cost is (just over) £15.00 per hour.

- At Time and a Half their hourly cost for overtime is £22.50.

- They drive 1,000 miles a month.

- Company vehicles average 30 MPG. Fuel costs £1.45 per litre.

- If the employee uses their own vehicle (aka the 'Grey Fleet') they are paid the standard AMAP rate of £0.45p per mile.

Outcome

- The employee only does a 38 hour week – they regularly start late or end early. Getting them to do a full week's work (40 hours) saves the company £130.00 per month.

- The employee rounds their overtime claims up by 2 hours per week. Paying the right amount of overtime saves the company £195.00 per month.

- The employee is only 80% productive – they waste time during the day. Improving their productivity by only 5% to 85% saves the company £133.50 per month.

- 10% of the mileage the employee does in a company vehicle is non-productive (e.g. private journeys). Avoiding this non-productive mileage saves the company £22.00 per month in fuel.

- The employee speeds habitually. By reducing their speeding the MPG improves by 10% (from 30 to 33 MPG). This saves the company another £20.00 per month in fuel.

- Another employee using their own vehicle on business overstates their business mileage by 24.7% (according to industry experts this is the average in the UK). Paying them the right amount for business mileage saves the company £112.50 per month.